| Home | About Us | Resources | Archive | Free Reports | Market Window |

The U.S. Gov't Owes You $1 MillionBy

Tuesday, November 19, 2013

It's a funny thing about people and lies…

If a lie lasts long enough... and is repeated enough... it becomes a kind of truth. Not a real truth, of course... just a lie that has become accepted and respectable.

That's what's happening right now to the idea of inflation...

Long (and rightfully) seen as the bane of the working man, the inevitable consequence of paper money, and a hidden tax... inflation has suddenly become not only acceptable, but lauded. In fact, central bankers and economic leaders – people who should really know better – are now saying in public that what we really need is more inflation.

Three weeks ago, The New York Times published what I would describe as an ode to inflation. Said the Gray Lady:

People who believe that inflation will lead to an increase in prosperity or our standard of living are simply fools. Cutting more slices out of a pizza doesn't create more pizza. What inflation does accomplish is shift the dynamics of who wins and loses in our economy. Very simply: People whose income and wealth are manufactured through their asset base become vastly wealthier on a relative basis. People whose wealth is tied to their labor and wages become vastly poorer.

For example, retailers want inflation because it enables them to mark up their goods. And combined with negative real interest rates (like we have now), they can maintain inventories for free (or even to produce a carrying profit). The school board knows that inflation will eat away at the real costs of the wages it must pay. And the federal government – the world's largest debtor – needs both inflation and negative real interest rates to pay for the absurd promises it has made to voters.

In current dollars, based on the net present value of all of its current and future obligations, the federal government owes more than $1 million to every citizen of the United States.

Hopefully, you realize that these promises cannot be kept. What you might not realize is that absent negative real interest rates (driven by inflation), the federal government's current obligations couldn't be financed.

Inflation, unlike what our economic leaders seem to believe, isn't Santa Claus. It can't bring gifts to everyone. All it does is shift the benefits of our economy around. In the immortal words of President OBAMA!... inflation "spreads the wealth around a little."

Inflation penalizes wage earners for the benefit of asset owners. It benefits debtors at the expense of creditors. There's no net increase in the nation's wealth. One group is merely taxed for the benefit of the other. This is sold as a benefit to the country by our government. It has to sell it to us because without inflation it couldn't pay its bills.

Ironically, left-leaning middle-class citizens believe in the benefits of mild inflation most fervently. They are simply bad at math.

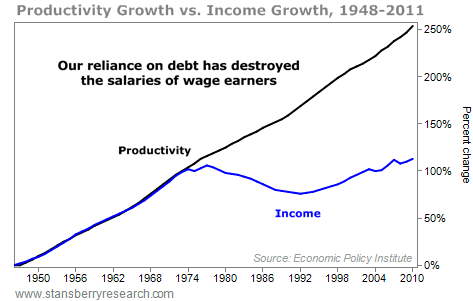

Since 1971, when we left the gold standard currency system, wages have stopped tracking gains to productivity. In the past, when innovations would cost some workers their jobs, there was a reciprocal benefit: The real value of wages increased at the same pace as productivity. Thus, they could be nearly assured higher wages in their next position.

The fact that wages were tied to productivity through a stable, gold-backed currency was what propelled the middle class to prosperity. And it led to the United States' political dominance.

But as you can see in this chart, based on one originally published by the Economic Policy Institute think tank... when we took the dollar off gold and allowed the central bank to continuously debase the currency, the dollar and the wages paid in the dollar no longer kept pace with inflation. Thus today, when trade or innovation leads to a gain in productivity (and the loss of a job), there is no reciprocal benefit to wages for the middle class. The replacement job is sure to come at a much lower real wage.

It's this gutting of wages that most appeals to corporate America. To the wealthy, inflation provides easy ways of increasing the size of their asset base: All they have to do is borrow money at a negative real rate of interest and buy up productive assets. That's why farm prices have soared, why private-equity funds now control trillions in assets, and why the wealthy now dominate the middle class politically. There are two good reasons to believe our current love affair with inflation will end badly…

First, real wages have fallen so far and for so long that they are no longer attractive to many workers. The lack of labor participation has become an enormous burden with a record number of healthy Americans no longer working and instead living on taxpayer-funded assistance.

The other, even more powerful reason is that negative real interest rates have enabled our government to borrow truly unbelievable amounts of money. Not only will this eventually lead to a crisis in the U.S. Treasury market (with soaring interest rates), but this chronic borrowing has transformed America from the world's largest creditor nation (with massive income from global investment) into the world's largest debtor nation.

Foreign investors now own $5 trillion more of America's best assets than we own of foreign assets. Generations of Americans will be sending foreigners net investment income, month after month. If these capital flows continue, it won't be long before no one wants to hold a U.S. dollar.

What's the trigger? When will my dark fears about the future of our economy come to fruition? When will the inevitable next crisis strike? No one knows, of course. My "canary in the coal mine" is the dynamic between the price of gold (which represents sound money) and the price of U.S. long-dated Treasury bonds (which represents the global paper money system).

You can track long-dated Treasury bonds (which mature in 20 years or more) by tracking TLT on the stock market. It's an exchange-traded index fund that holds a basket of long-dated U.S. Treasury bonds. Over the last year, it's down by 15%. You can track gold using the SPDR Gold Shares Fund (GLD), which holds gold bullion. Over the last year, gold has corrected significantly (after a massive 12-year bull market) and is down about 25%.

When the market finally realizes that inflation isn't good for the economy... that wages are far too low... and that debts are far too high, you won't want to be holding U.S. long-dated Treasury bonds. I expect within the next few years, we'll see a real panic in Treasury bonds, with annual yields reaching more than 10%. Many investors will flee into gold, as the U.S. dollar will be seen as unstable.

You'll see a dramatic inversion between TLT (which will collapse) and GLD (which will soar). This prediction, by the way, isn't really a prediction at all. It's a trend. Over the last five years, gold has outperformed the long bond by more than 100%.

That tells you all you really need to know about inflation.

Regards,

Porter Stansberry

Further Reading:

Porter has been following the U.S. bond-market bubble for years. He thinks it's "without a doubt the single greatest threat to your wealth you will ever face." And for those who don't own gold, "it could soon be too late." Catch up on Porter's commentary here, here, and here.

Dr. David "Doc" Eifrig has showed DailyWealth readers how powerful it can be to hold "chaos hedges" – like gold – in your portfolio... "When investors get nervous about bad economic news... debt crises in Europe... and the specter of runaway inflation in the United States," he writes, "stocks fall, and gold and silver rise." Learn how Doc protects his wealth with precious metals here and here.

Market NotesTWICE THE RETURNS OF THE S&P 500 Today's chart shows that Steve Sjuggerud was right. Japanese stocks have been a great investment in 2013... more than twice as good as U.S. stocks.

Last November, Steve urged readers to buy Japanese stocks. He said the changing of government leaders ensured the country would enact major stimulus programs... and push the value of Japanese stocks much higher. In February, Steve called Japanese stocks his "favorite investment of 2013."

The best way to track the Japanese stock market is with the "Nikkei" average. It's the "Dow Industrials of Japan." It tracks the share-price movements of major Japanese companies, like Toyota, Mitsubishi, and Honda.

As you can see from the chart below, Steve's call was well-timed. The Nikkei skyrocketed in the first part of the year... "digested" its gains... and just broke out to a five-month high. The index is up 65% over the last 12 months... compared with a 30% return in the U.S. benchmark S&P 500 Index.

Steve was right... It's proving to be a good year for Japanese stocks.

|

In The Daily Crux

Recent Articles

|